Navigate here 👇

Article 77 of Saudi Labor Law deals with the penalty for breaking an employment contract by an employer or employee in Saudi Arabia. In case of unfair termination of the agreement, the employee and the employer are entitled to some compensation, as explained below.

Never pay the full price🏷️; join the 📢Saudi Coupon Codes group and get sales updates and discount codes in one place.

Penalty Clause in the contract

If the penalty for the early termination/resignation or breaking the contract is written within the employment contract, Article 77 will not apply. Instead, the clause in the contract will apply.

Article 77 (1) – Indefinite Contract

If one party terminates an indefinite contract without a valid reason, the other party (employee or employer) is entitled to get 15 days’ salary for each year of service as per Article 77 (1) of Saudi Labor Law.

- Compensation: 15 days’ salary for each year of service.

- Only Saudi employees can have an indefinite contract.

Article 77 (2) – Fixed Contract

In case of termination of a fixed-term contract without a valid reason, the other party is entitled to pay the salaries for the remaining contract period as per Article 77 (2) of Saudi Labor Law.

- Compensation: Full salaries for the remaining period of the contract.

- All expats working in Saudi Arabia have a fixed-term contract.

- If an employee resigns without finishing his contract, he must compensate the employer by paying the salary for the remaining contract period and vice versa.

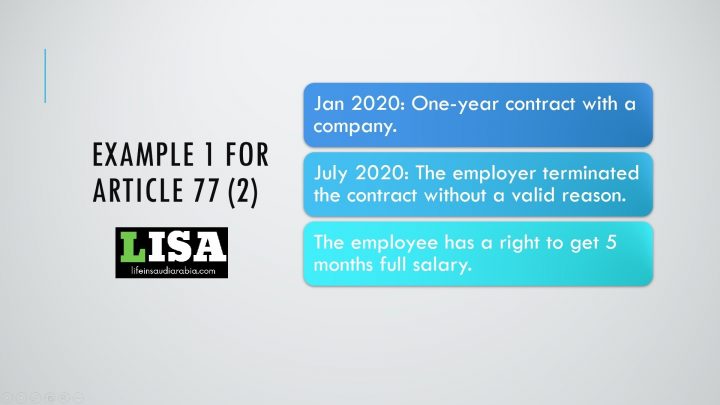

Example 1

- Jan 2020: An expat signed a one-year contract with a company.

- July 2020: The employer terminated the contract without a valid reason.

- The employee has a right to get 5 months full salary per Article 77 (2) of Saudi Labor Law.

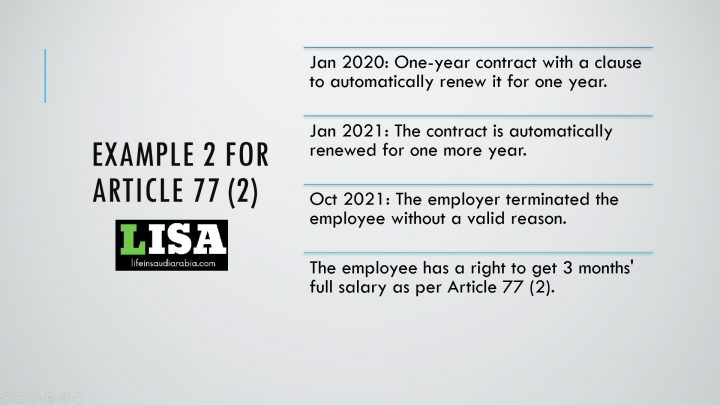

Example 2

- Jan 2020: An expat signed a one-year contract with a company with a clause to automatically renew it for one year.

- Jan 2021: The contract is automatically renewed for one more year.

- Oct 2021: The employer terminated the worker without a valid reason.

- The employee can get 3 months’ full salary per Article 77 (2) of Saudi Labor Law.

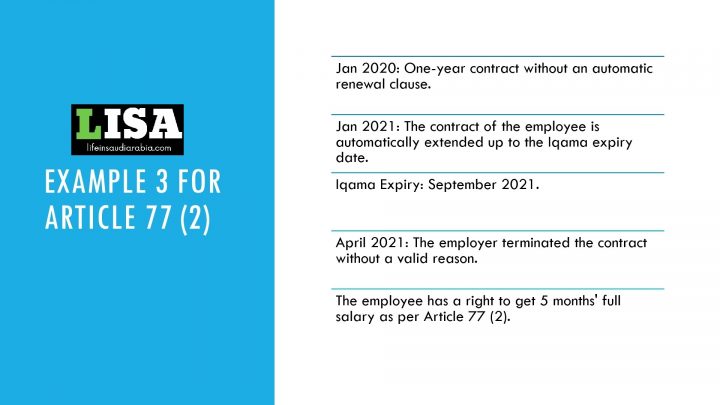

Example 3

- Jan 2020: An expat signed a one-year contract with a company without an automatic renewal clause.

- Jan 2021: The employee’s contract is automatically extended for one more year as per Article 37 of Saudi Labor Law.

- April 2021: The employer terminated the employee without a valid reason.

- The employee has a right to get 9 months’ full salary per Article 77 (2).

Article 77 (3) – minimum compensation

The compensation paid under Article 77 of Saudi Labor Law must not be less than 2 months’ employee salary.

FAQs

Can an employer deduct Iqama Fee and Insurance cost after Resignation?

- As per Article 40 (1) of the Saudi Labor Law, it is the responsibility of the employer to pay for the iqama renewal of iqama issuance fee.

- As per Article 144 of the Saudi Labor Law, it is the responsibility of the employer to provide health care and insurance to each employee.

Therefore, the employer can deduct neither the iqama fee nor the health insurance cost from the salary after the resignation. All the deductions which an employer can make from your salary are covered in these two articles;

- Salary Deduction Rules in Saudi Labor Law.

- Article 77 of Saudi Labor Law (explained above).

Labor Court Cases

In several cases, the labor court issued a decision in favor of an employee to get the total compensation per Article 77 of Saudi Labor Law. We have listed some of them below;

- Aug 2021: Saudi Hospital to pay SR 300,000 to a terminated doctor.

- Aug 2024: Riyadh court awarded an employee SR275,000 in compensation for her arbitrary dismissal from service before the completion of her contract period under Article 77.

For the latest updates, you can join our ✅WhatsApp group or ☑️ Telegram Channel.