Navigate here 👇

After a car accident in Saudi Arabia, you have to follow the Najm accident procedure, get Muroor Report, Taqdeer Report, and claim the money from the insurance company. Here is the process;

Call Najm or Traffic Police

In case there is fire, injury, or death in a car accident or none of the parties has insurance, call traffic police at 993.

Never pay the full price🏷️; join the 📢Saudi Coupon Codes group and get sales updates and discount codes in one place.

Call Najm at 920000560 or through the Najm app if any party involved in a car accident has valid insurance.

- Najm WhatsApp Number: 920000560.

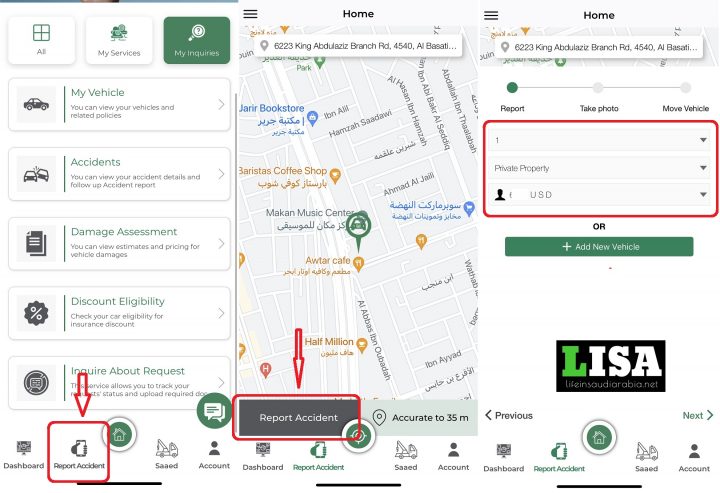

- Download the Najm App from either Playstore or iTunes.

- Select the English language.

- Create an account using the Iqama number.

- Approve the account using the Nafath app.

- Go to the Home screen in the Najm app and click on the “Report Accident” button.

- Add the details of the other car which was involved in the accident.

- Take photos of the cars and upload them to the Najm system.

- Soon, you will be assigned a surveyor.

Najm Accident Procedure

The Najm accident procedure starts with the surveyor evaluating the cars and accident site, asking you to explain how the accident happened, and determining the responsibilities.

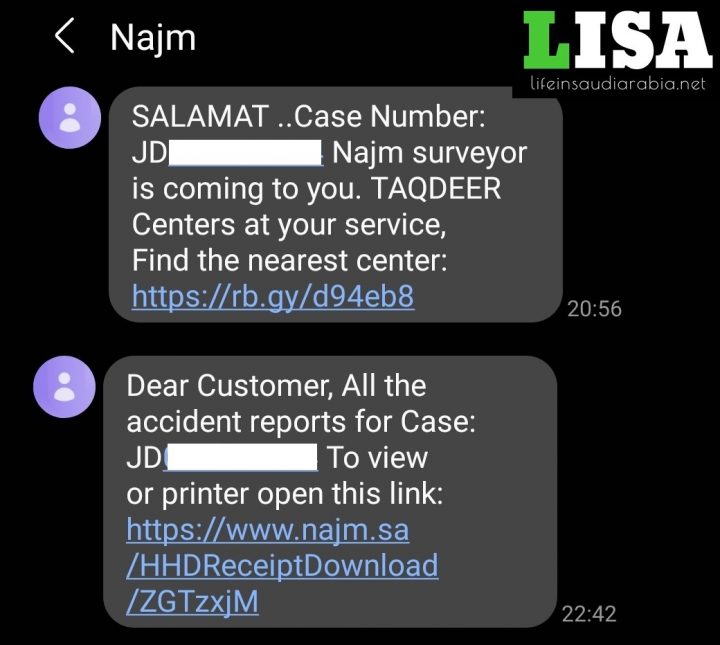

Soon you will receive an SMS from Najm that your case has been registered.

After a while, you will receive another SMS from the traffic police confirming that your Muroor accident report has been registered.

If you were driving a rental car, you need to contact the company from whom you have taken the car. They will complete the rest of the process.

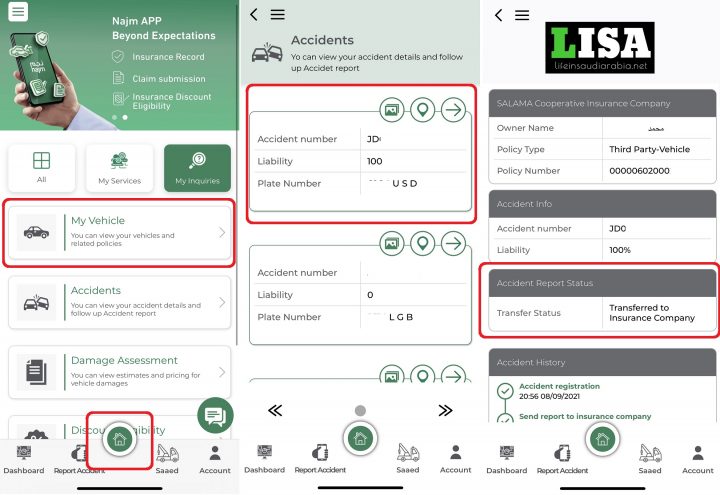

You can check the status of your accident report through the Najm application;

- Log in to your account.

- Select “Accidents“.

- Click on the recent accident.

- View the accident report.

Taqdeer Report

Now you need to follow the procedure to get the assessment of your damaged car done by Taqdeer. Here is the process to get Taqdeer Accident Report.

Claim the money from the insurance company

Third Party: Now you need to claim the money from the insurance company of the person who is responsible to pay the claim by uploading the documents to their website online.

Comprehensive: If you have comprehensive insurance and the accident reports hold you 100% responsible for the accident, you need to submit the insurance claim to your insurance company.

After a while, you will receive an email from the insurance company that your claim has been submitted. You will be paid within 15 days of this SMS.

Leased Car: If you have a leased car from a bank or another company, it means that you have a comprehensive insurance and therefore, you need to submit the claim to your insurance company.

If the other party doesn’t have insurance

If it is the other party’s fault and he does not have insurance, your line of action would depend on your insurance type.

- Get Muroor Appointment.

- Visit Muroor Office with the Taqdeer report.

- Fill out the form given by the traffic police officer.

- The officer will try to call the other party and help you to get the funds.

- You should insist Muroor officer issue the final report.

If you have comprehensive insurance, you should submit the final report to your insurance company and let them handle this person. They will repair your car straight away and take money from him later.

If you have third-party insurance, follow the process explained below;

- Submit the case to the Najiz platform.

- Najiz will refer you to the Taradhi platform for reconciliation.

- MS Teams session would be scheduled between the two parties.

- If you agree on the reconciliation, the Judge will issue the verdict.

- Contact the other party and give him your account number for payment.

- If he does not pay, log in to your Najiz platform and submit a case through تنفيذ (implementation court). The court will recover the funds.

Vehicle repair permit from Absher

Once you are ready to repair the car, you need to issue a vehicle repair permit from Absher. The car mechanic would require a vehicle repair permit to repair the car.

Hit-and-run cases

If you fail to stop your vehicle at the place of the accident, it is considered a hit-and-run case for which you can be fined SR 10,000 and jailed for 3 months as per Article 63 of the Saudi Traffic Law.

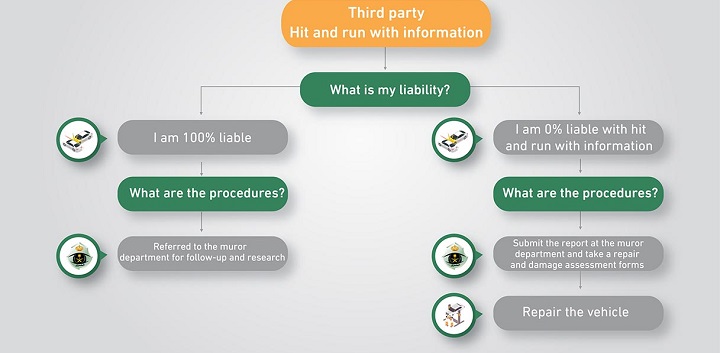

In hit-and-run cases of car accidents, you need to follow a separate procedure in Saudi Arabia.

Hit and Run – Third-party Insurance

If you have third-party insurance in Saudi Arabia and somebody hits your car and runs away, you need to;

- Note down the car number plate of the vehicle running away.

- Submit the accident report to the traffic police.

- Get the repair damage assessment and submit it to the Muroor.

- Repair the vehicle.

Hit and Run – Comprehensive Insurance

If you have comprehensive insurance in Saudi Arabia and somebody hits your car and runs away, you need to;

- Note down the car number plate of the vehicle running away.

- Submit the accident report to the traffic police and get repair permission.

- Get the repair damage assessment from Taqdeer.

- Submit the insurance claim to your insurance company.

Traffic accidents causing death or injuries

A motorist caught causing a serious traffic accident that results in deaths will be;

- Jailed for 4 years and,

- fine with SR 200,000.

A motorist caught causing a serious traffic accident causing injuries that last for more than 15 days will be;

- Jailed for 2 years and,

- fine with SR 100,000.

For the latest updates, you can join our ✅WhatsApp group or ☑️ Telegram Channel.